How to Build Your Business Credit Score

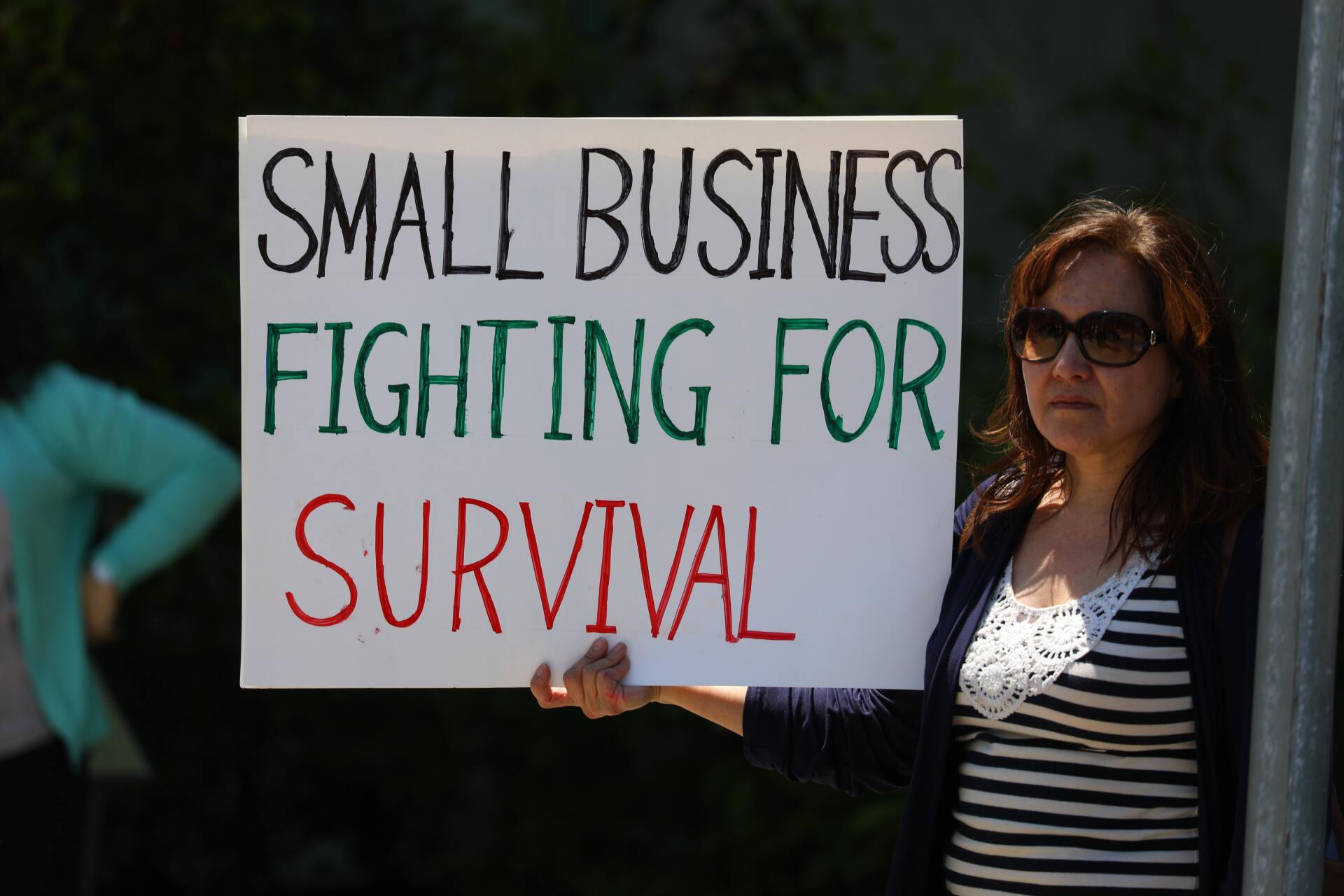

Just like individuals need good credit scores to save money and access funds for life’s adventures (and curveballs), businesses also need good credit scores. Whether it’s taking out a loan to get you through a state lockdown, fulfill a purchase order, or take your business in a new direction, at some point you’re likely going to need to speak to a lender. Personal loans place your own assets at risk, which is why it’s smarter to prepare your business for its own financing.

To keep your personal life separate from your professional life, your business needs to have its own strong credit score. Here’s how to do it.

Incorporate as a Business Entity

When you incorporate your business, you are creating a legal entity for your business that exists apart from you, meaning all of your company’s assets and income are separated from your own. Even though you built your company, in the eyes of the courts you are no longer a single entity.

There are several advantages to incorporating your business. In fact, you could write several books about it if you were so inclined. However, in regards to your business’s credit score, the reason you want to incorporate your business is so you can get an employee identification number (EIN).

Once you have an EIN, your personal credit score and your business’s credit score are no longer linked.

Get Separate Business Bank Accounts

Once you have an EIN, you can then open a business bank account, which you will then use to conduct all of your company’s business transactions. Use a credit card for your business? From now on, you’ll make all payments from your new bank account. Need to pay your employees? Business bank account. Everything that you used to take personal responsibility for from your own bank account, will now be done from your business bank account.

Open a Separate Phone Line for Your Business

It doesn’t matter what kind of phone you choose (landline, cellular, or VoIP). All that matters is that it’s in your business’s name and not yours. If your business already has an established phone number, but it’s in your name, call your provider and get it transferred. This is often an easy process, so you shouldn’t have any problems doing so (though it may not happen in a single business day).

Also, to further expedite your company becoming its own entity, you should also list your business in a public directory so people can easily find it when running a search.

Choose Vendors Who Report Your Payments

To build a truly strong credit score, you need companies to report your on-time payments. Therefore, try to work with vendors who actively report your payments to the credit bureaus. Ideally, you want five or more. If you need to work with a specific company who doesn’t currently submit your payment history, ask them to start. It’s not hard, and if they want to keep your business, they’ll do it without question.

Keep Up with Bills and Creditors

To improve any credit score (whether it’s a personal or business credit score) you need to pay your bills on time. You also need to keep a good credit utilization ratio. Anything under 10% is best. That means keeping a low or zero balance on your business credit cards and not maxing out lines of credit.

As you pay your bills on time and pay down your debt, your business’s credit score will get stronger and stronger as the months go by.

Ready to put that credit score into action? Find the financing you need to take your business to the next level.